Checking The Pulse Of The Kansas City Real Estate Market

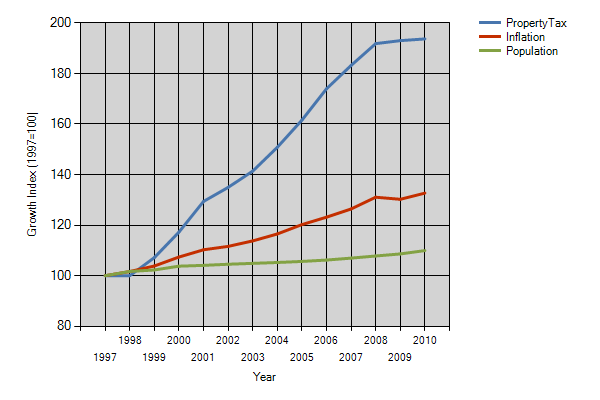

More than 1/3 of all property taxes collected in the state of Kansas come from property taxes. In 2010, property taxes accounted for 35% of the taxes collected overall by both state and local governments across Kansas. According to the KS Department of Revenue, taxes increased 94% between the late 1990’s to 2010. These taxes brought in $1.97 billion dollar in tax revenues in 1997 with that figure jumping to $3.8 billion in 2010. Check out the startling trend of rising property taxes compared to inflation rates.

Though the short-term trend in the chart shows more moderate property tax increases since 2008, the Kansas Association of Realtors is concerned that some sort of property tax reform will be required if we are to avoid a continuation of this troubling trend. Should we see a similar doubling of property taxes within the next decade or so, that trend would not benefit hopes for a housing rebound in the near future. It would certainly put more homeowner’s under water and the dream of homeownership out of reach for many more.

Posted by Jason Brown