Checking The Pulse Of The Kansas City Real Estate Market

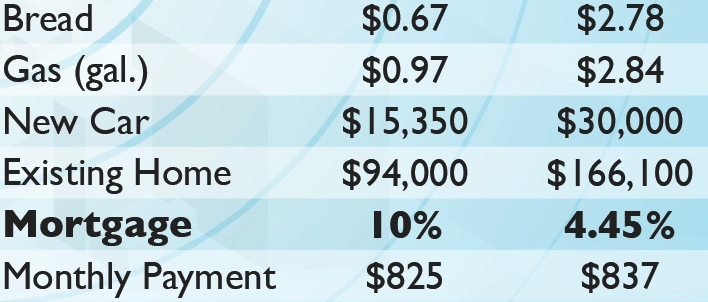

The stats below have been sitting on my desk for some time now and I just got around to looking them over. It was eye-opening and something I wanted to share it here. The stats compare recent prices to prices from about 20 years ago. Take a look and you’ll see how much bread, gasoline, vehicles and home prices have gone up. Then take in that mortgage interest rates have been cut in HALF — that critical detail has kept the average monthly mortgage payment virtually the SAME as two decades ago.

Gas prices have nearly tripled… Car prices have doubled… Average home sale prices have nearly doubled… Despite all this, because mortgage rates are at historical lows, the average monthly mortgage payment is virtually UNCHANGED! The Johnson County Kansas real estate market has been stable for well more than a year. Add in that mortgage interest rates have nowhere to go but up and that makes this one of the best opportunities ever to buy a first home or make the move up that you’ve been delaying.

Posted by Jason Brown