Checking The Pulse Of The Kansas City Real Estate Market

I’m intrigued by how our down housing market has many home buyers running scared. There are of course risks in any investment you make, but we need to remember that while our down market is bad news for many home sellers, it’s GREAT news for most home buyers. Values are down like never before but if our market is now stabilizing – as it appears to be now in many areas – there’s going to be a lot of disappointed people who missed a golden opportunity. Look at this as an amazing time to explore your options for buying a home. Or in selling your current home and buying another.

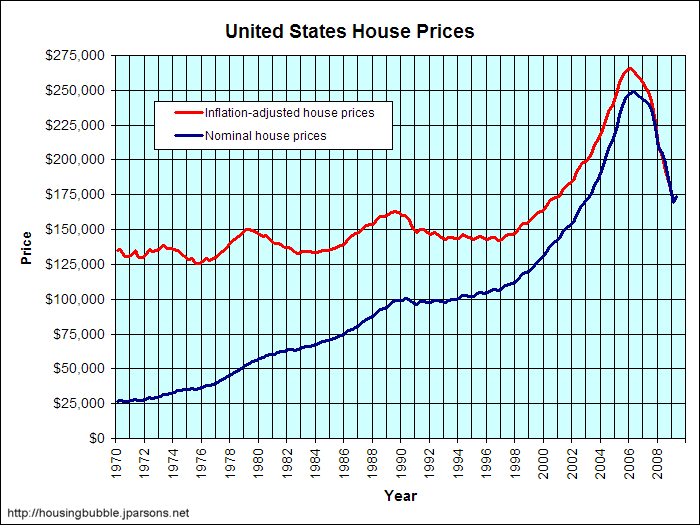

On the graph above, take a ruler and lay it along the line you see from 1970 through the year 2000 (when began seeing unprecedented appreciation rates. It works about the same on either the red or blue lines. What you find is that were at a point now where we probably should have been at anyhow — before the steep rise and prices AND after the correction we’ve seen the past few years. Again, we don’t know that we’re at the bottom of the market, but this graph would lead me to believe we are. Real estate has been one of the safest investments since the great depression and if you keep the long-term trends of real estate in mind, the question I’m asking home buyers right now is “why WOULDN’T you buy a home today?”

Our current real estate market could easily be the best chance you’ll ever have to get in a home larger than you ever hoped and to also make equity gains that others won’t see when jumping in AFTER we’re already well into a real estate market recovery. The deals that are out there right now for Johnson County Kansas home buyers should provide a huge cushion even if the market should dip further. Don’t be one of those buyers who were happy to buy in a seller’s market and pay a premium price but are now too shy to take advantage of the amazing buying deals in today’s buyer’s market.

As a buyer, YOU hold the cards. I know this as your buyer’s agent. The listing agent knows it. And, most importantly, most Johnson County Kansas home sellers are acutely aware of the market conditions. There are deals to be had everywhere from your typical resale homes to foreclosure listings, Short Sale listings and investors who have lost their shorts and are looking to get out of the market. So get out there and see if the home you want is available at a price you may never see again.

38.982228-94.670792