Checking The Pulse Of The Kansas City Real Estate Market

When getting Pre-Approved for a home loan, there’s more to the process than just rushing to get the Pre-Approval Letter in hand. Yes, that letter tells you the lender is willing to give you a loan. But what it doesn’t tell you is how much your monthly mortgage payments are going to be. And, if you ask me, that’s the most important aspect of getting Pre-Approved. Of course closing costs are very important too, but it’s the monthly payments that you could be faced with making for 5, 10, 15 years…

So be sure you consider each component that makes up your monthly mortgage payment. PITI is an easy acronym to remember for the four core aspects of a monthly mortgage payment. They stand for Principal, Interest, Taxes and Insurance. The Principal is the portion of each monthly payment that’s being deducted off the total amount you still own on the home. In other words, if you’re selling your home later and $5,000 of your monthly payments over the years have gone towards principal, that’s $5,000 in equity you’ve built up by way of your monthly payments.

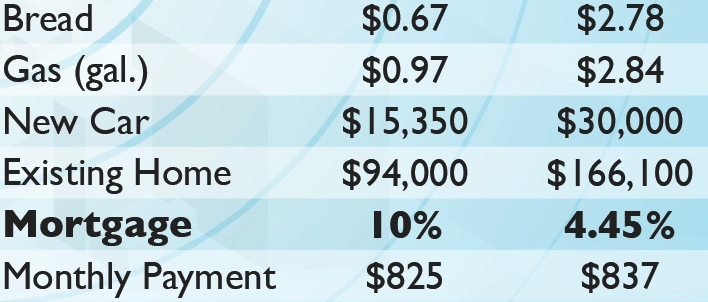

The next aspect is Interest. We all know what this is. It’s how the lender profits by loaning you the money to buy the home. If the principal and interest portion of your monthly mortgage payment is $1,000 per month, possibly $950 of each payment is going to interest. This is certainly the case in the first several years of a mortgage loan because mortgage loans have the earliest payments front loaded with interest. This is how mortgage loans have been done for decades and essentially your monthly mortgage payments are being recalculated each month based on the new loan balance (after taking your previous month’s payment into consideration). In case you’re wondering at what point would the principal pay-down portion of a monthly mortgage payment equal the interest portion, I belive it’s somewhere around year 20 on a 30 year mortgage loan.

The next aspect is Insurance. By insurance we mean Homeowner’s Insurance – a.k.a. Hazard Insurance. If you’re home burns down, Homeowner’s Insurance is what’s going to rebuild the home. Why do lenders require this be included in your monthly payments (if you have less than a 20% down payment)? Well, for a buyer who has just a 5% down payment, it would mean the bank actually “owns” 95% of the risk in your home. So, if it burns down, the borrower lost 5% of the asset but the lender would be losing 95%! If a borrower has more than a 20% down payment, most lenders feel the borrower has such a big interest in making sure the home has insurance in place that they don’t require it be included in the borrower’s monthly mortgage payments.

The next aspect of the mortgage payment is Taxes. By taxes we mean County Property Taxes. Your lender doesn’t want a lien placed on your home by the government in the event you don’t stay current on your property taxes. So, if you have less than a 20% down payment, the lender will collect your property taxes in your monthly payment. This portion of your monthly payments goes into an escrow account so the money is there when the property taxes actually come due. This is important to the lender because if they have to foreclose on you in the future, they won’t have to worry about the government standing ahead of them in line with an interest in the property.

But wait… there’s more. Although PITI are the four main aspects of a monthly mortgage payment, if you have less than a 20% down payment you can also expect to add a fifth critical item to the equation — Mortgage Insurance. Borrowers with less than a 20% down payment are considered higher risk loans. To cover this risk, lenders will require the borrower to pay for Mortgage Insurance, which means the borrower is paying for insurance that guards against possible losses the lender might incur from the borrower defaulting on the loan. Also, some condo and townhome association dues are collected as part of the borrower’s monthly mortgage payment, thus adding a sixth component to the monthly mortgage payment for some borrowers.

38.982228-94.670792