The Jason Brown Group

Putting our clients at a competitive advantage

View an updating list of homes for sale within a mile of your GPS location!

USE GPS TO VIEW ACTIVE LISTINGS

DOWNLOAD FREE MOBILE APP

FREE BUYER HOME WARRANTY

HOME BUYER PROMOTION DETAILS

FREE SELLER HOME STAGING

HOME SELLER PROMOTION DETAILS

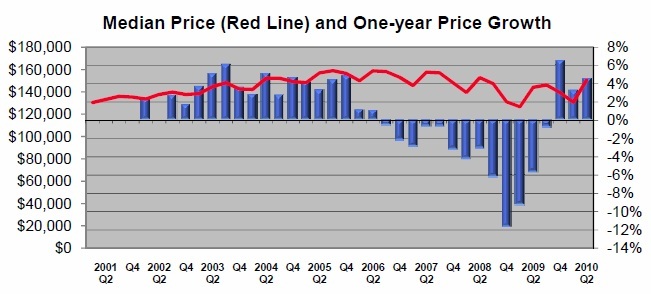

MARKET INFO ON ANY ADDRESS

MARKET INFO SENT INSTANTLY

JASON BROWN GROUP REVIEWS

5 STAR REVIEWS ONLINE

$500 MILITARY SERVICE THANK YOU

VIEW PROMOTION DETAILS

The Jason Brown Group

Five Star Client Satisfaction Award 12 times

Involved in the sale of 1,000+ area homes

Top 1% area Keller Williams agents past 17 years

Member of office’s ALC board of directors

Elite online presence with 1 million+ visitors

Exceptional service is priority #1

Know someone planning a move… Can you help us make a connection?

Jason Brown

Phone: 913-915-6008

Email: jasonbrown@kw.com

The Jason Brown Group with

Keller Williams Realty Partners

#1 producing real estate office in the metro

6850 College Blvd, Overland Park KS 66211

Licensed in Kansas and Missouri

Supporters of Children’s Mercy Hospital

Supporters of The American Cancer Society

Five Star Reviews ~ Check us out on Facebook

Posted by Jason Brown