Checking The Pulse Of The Kansas City Real Estate Market

The latest market stats from the Kansas Association of Realtors covering the January state-wide real estate activity show home sales rose 3.8%. This improvement follows up a 1.3% rise in the volume of homes sales when we checked last month. The continued demand for homes is a good sign as we head towards the spring selling season.

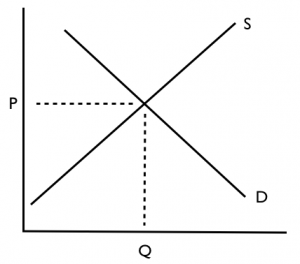

Overall in the state of Kansas, we moved from a seller’s market and into a balanced real estate market with 6.4 months of inventory on the market. This is up from the 4.8 months of inventory at last month’s update. Despite the balanced real estate market, home prices in Kansas continued to rise and were up 2.6%. This follows up a 1.4% rise in sales prices at last month’s check.

Locally in Johnson County Kansas, a seller’s real estate market continues with 441 homes sold (closed) during the past 30 days. Compared to the current volume of homes for sale in Johnson County Kansas, we have 4.1 months of inventory currently for sale in the county.

Posted by Jason Brown