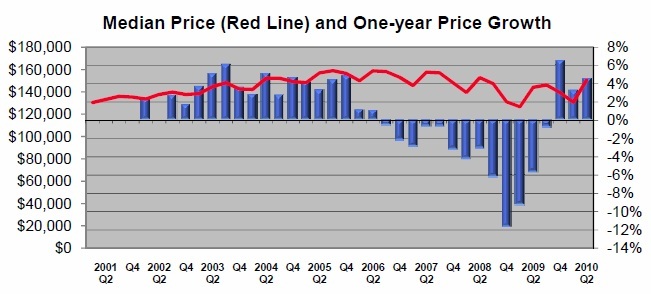

Checking The Pulse Of The Kansas City Real Estate Market

There are lots of reasons that top Kansas City listing agents have their home sellers closely review the MLS listing after it goes Active. I believe it’s absolutely vital that buyers and buyer’s agents are given accurate information on a property. Buyer’s are certainly basing their purchase decision not just on their visual inspection of a home but also on the information being provided about the home. I’ve never had it happen to one of my clients, but I’ve heard a lot of stories of mistakes costing sellers or listing agents several thousands of dollars. The old story of, I’m sorry but the Seller’s Disclosure said the refrigerator was staying should keep every Kansas City real estate agent working hard to present accurate property information.

In addition to giving accurate information, it’s important that a home’s features aren’t overstated in a manner that’s deceiving or understated in a way that prevents buyers from getting excited about scheduling a showing on a home. Personally, as soon as one of my listings goes Active, I send my sellers a link to the MLS listing, a link to the listing on my web site and an attachment with their home brochure. I give them time to review this info before we produce any further marketing pieces. Our information is usually spot on, but if we have indicated a wrong elementary school serving an area or missed checking that a home has a humidifier present, it’s important that we correct this immediately.

A good listing agent prides themselves on taking quality photos and allowing the seller to review the photos early in the process. Having another set of eyes – especially the people who know the home better than anyone else – look things over is never a bad idea. It’s BOTH the seller and listing agent’s job to present accurate info, so I really can’t imagine a seller NOT reviewing their MLS listing for accuracy. It really is a shock to me that so few agents take this step.

So what are some the of the most irritating and ridiculous things I’ve seen as a Kansas City Buyer’s agent? A pet peeve of mine is when a listing agent puts the words “see Mapquest” under the directions portion of MLS. Seriously? I don’t understand how anyone could be so lazy as to skip over the directions to the home – without getting people to the home, you have NOTHING.

Another of my favorites is the one photo listing. I don’t care if the listing is a bank foreclosure, every home should have tons of photos. Photos sell homes and it’s apparent to me that many foreclosure listing agents don’t care about getting top dollar for their listings and they know the seller (the bank) won’t even realize it doesn’t have lots of photos. NO photos are worse than bad photos because just imagine the visions running through a buyer’s mind when there are NO photos present.

38.982228-94.670792