Checking The Pulse Of The Kansas City Real Estate Market

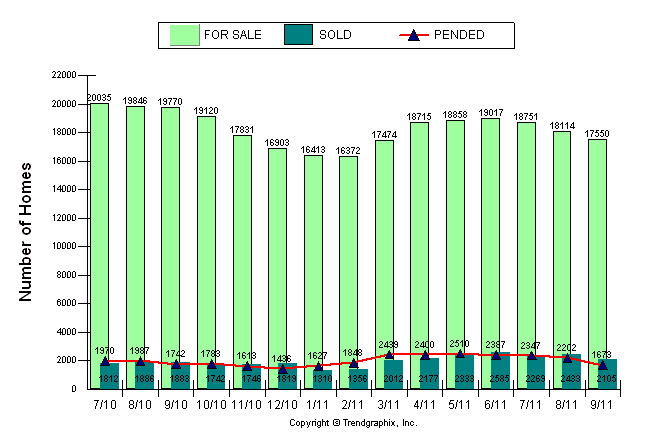

If you’ve been following my real estate updates on Kansas City, Johnson County, Overland Park and the surrounding area, you’ve probably noticed that the months of inventory in most areas has been improving for several months now. An improved home sale rate coupled with fewer listings hitting the market has cut the amount of inventory drastically. Just ask one of your friends or family members who’s been out shopping for homes and they’ll probably tell you there’s fewer options than they expected. It’s true that the past several years most buyers had so many options their heads would spin. But that trend has been changing in recent months.

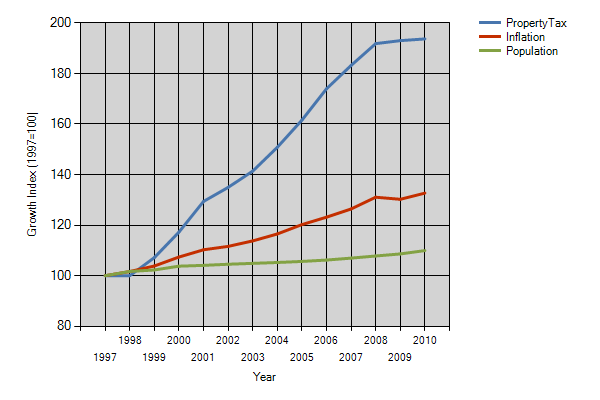

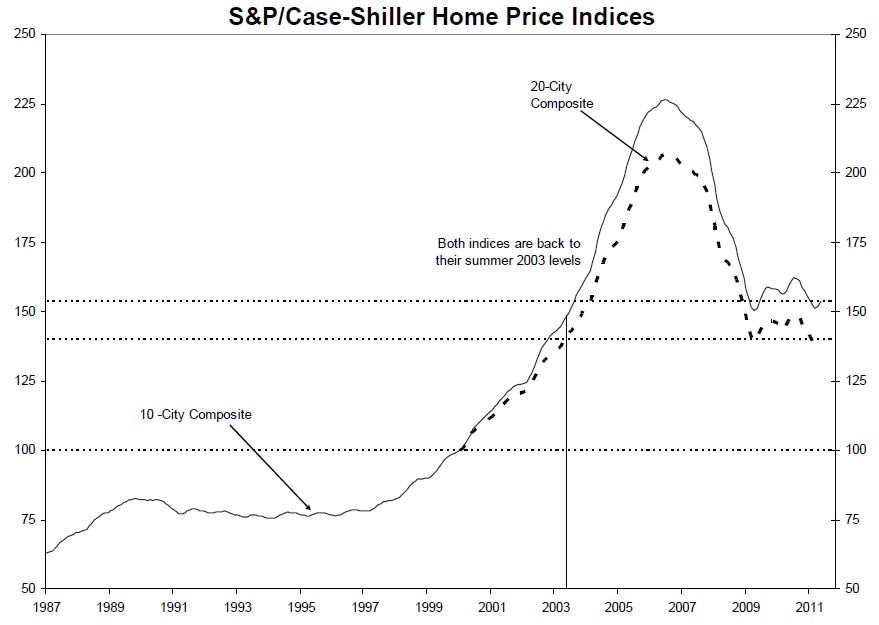

Though home prices have still fallen slightly in the past year, the improved sales rate could be foretelling of what’s on the horizon. Before home sales prices begin an upward climb, an improved sales rate must first be established. Since it takes some time for a home to close and because it can take a while for buyers to comprehend that the market has changed, I think it will take at least 6 months after a recovery has begun before home sales prices follow suit. If we’re at that point now, waiting several months to buy a home could leave a buyer in a much more competitive market.

We’re already seeing some sellers pushing back more than they have in years. When a seller realizes there’s less competition on the market, they’re going to arch their backs more. They’ll begin providing fewer concessions to buyers and holding more firm on their price. A recent Bloomberg survey showed national home sales are at their highest level in two years. If these types of trends continue, it’s likely to lead us straight out of our current buyer’s market and into a balanced real estate market in the near future… And with interest rates sure to rise, there’s going to be a lot of home buyers regretting their missed opportunity.

Posted by Jason Brown