Checking The Pulse Of The Kansas City Real Estate Market

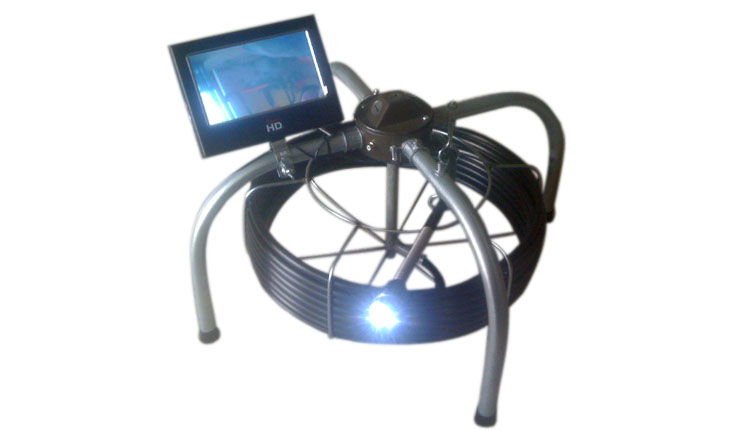

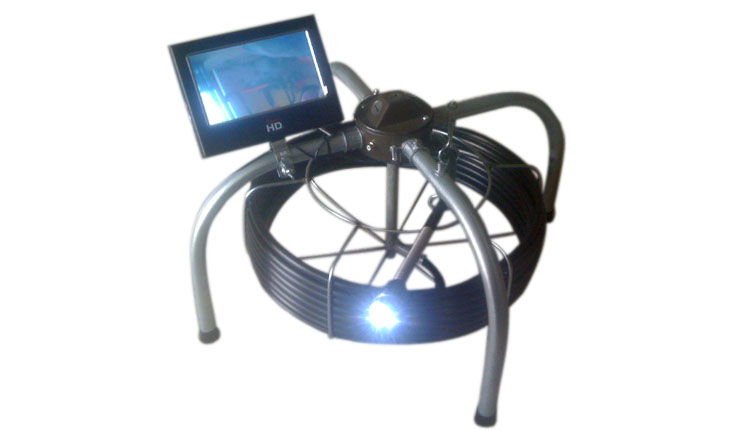

Older homes, like those found in Prairie Village Kansas, are wonderful homes often with lots of character and the appeal of mature tree-lined streets. While these features are precisely what draws many home buyers to the area, older homes on tree line streets are the homes that most often encounter sewer line problems. When buying a home, it’s important for your home inspector to run the sinks and tubs for a long period of time and be sure everything is draining properly in the home. If there’s any slow draining, it’s recommended that a home buyer have a professional company come out and complete a sewer line camera inspection.

Sewer lines don’t last forever and on homes that are 40, 50, 100 years old, someone is eventually going to get stuck with paying for sewer line repairs. And by sewer lines we aren’t just referring to the plumbing inside the home or under the basement concrete floor… We’re talking about the sewer line that runs from the home and through the yard to the street. But the homeowner’s responsibility doesn’t stop there either. Because main sewer lines run on one side of the street or the other, there’s a a 50-50 shot a homeowner’s sewer connects on the OTHER side of the street. If your sewer line goes bad, imagine the costs involved if the repairs require replacement of the sewer line under the street, tearing up the street, etc. It can happen.

Sewer lines don’t last forever and on homes that are 40, 50, 100 years old, someone is eventually going to get stuck with paying for sewer line repairs. And by sewer lines we aren’t just referring to the plumbing inside the home or under the basement concrete floor… We’re talking about the sewer line that runs from the home and through the yard to the street. But the homeowner’s responsibility doesn’t stop there either. Because main sewer lines run on one side of the street or the other, there’s a a 50-50 shot a homeowner’s sewer connects on the OTHER side of the street. If your sewer line goes bad, imagine the costs involved if the repairs require replacement of the sewer line under the street, tearing up the street, etc. It can happen.

It’s possible that a slow drain can be dealt with by having the lines rootered out or hydrojetted out, but the simple fact that there’s any issues should put a home buyer on notice that more expensive repairs could be coming. A root of a tree may have penetrated the sewer line or maybe the ground has collapsed underground and caused a sewer line connection to separate. Some older sewer lines are made of clay and simply not designed to hold up 100 years. Cleaning out the lines could be a temporary fix and the permanent fix could cost a homeowner thousands of dollars.

To find out what’s truly needed, have an inspection done where a small camera is run through the plumbing lines and out to the main sewer line. If major repairs are required, a good rule of thumb is $100 per foot to repair or replace the damaged pipe. But it could certainly be much more or even less, so be sure to get a couple bids before proceeding. Though I have never recommended this company, here’s a Kansas City sewer repair company with a web site that does a good job of explaining a homeowner’s options. You may be able to re-line the existing sewer line without trenching the yard. If you have to excavate and install a new sewer line, $100 per foot is probably a minimum cost.

Prairie Village Kansas has recently begun promoting to its residents the option of purchasing a Sewer Line Warranty. According to a Kansas City Star article, 12% of Prairie Village residents have already done so. The warranty is provided by a third-party and the current cost of the warranty is $59 per year. If there’s a problem, the warranty company sends out a local plumber and the warranty will pay up to $4000 of repairs to repair a broken line. Should the job require cutting up the street, the warranty would also cover the first $4000 of that portion of the repair.

Posted by Jason Brown

38.982228-94.670792