Checking The Pulse Of The Kansas City Real Estate Market

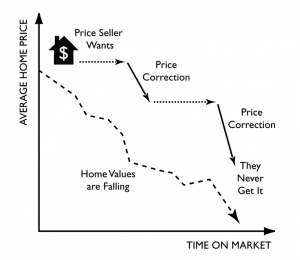

In today’s buyer’s market, it’s important that home sellers in Kansas City, Johnson County, Overland Park and our surrounding areas price their homes ahead of the market. Many sellers want to price their homes at a price that would have been appropriate 12 to 24 months ago and what they’re not seeing is that strategy is likely cause them to languish on the market. Homes that languish on the market almost always sell for much less than if they had been priced appropriately and went under contract quickly. Sellers must understand that buyer’s are looking for a deal like never before. This can mean that what appears to be a fair market value may not be enough.

Home sellers willing to price their home at market value still have a good chance of selling. But if you have a great need for your home to sell quicker than average, you’ll need to price your home AHEAD of the market. What does pricing your home ahead of the market mean? It means staying one step ahead of your competition. Let’s say there’s three homes on the market in your subdivision and they’re all very similar and all on desirable lots. Let’s say they’re priced at $200,000, $210,000 and $220,000. If you list your home at $220,000 you and your other $220,000 neighbor are just going to help push buyers to choose the lower priced homes. If you price your home at $200,000, you’ve now got a great shot at being the next home to sell in your subdivision.

Pricing your home AHEAD of the market can certainly get your home sold quickly and for top dollar. If the other home priced at $200,000 had an initial list price of $225,000 and has now languished on the market for 120 days, it’s likely they’re about to take another price drop. So, rather than list your home at $200,000 and be behind in this buyer’s market when that home seller drops their price to $195,000 tomorrow, why not price your home at $195,000 out of the gate and make your home the most desirable home in the subdivision?

If you think this strategy is underpricing your home, consider that homes that receive quick offers often sell for near full price. So if you list at $195,000 and go under contract quickly at $193,000, it could be much better than listing at $210,000, languishing on the market for 120 days and eventually selling for $185,000… Or even worse if we’re in a declining market and the home is worth significantly less several months down the road. Ask yourself, do you want to sell for the maximum price NOW (quickly and at top dollar) or for absolute top dollar no matter how long it takes? Then consider that pricing AHEAD of the market will often accomplish BOTH goals.

Posted by Jason Brown