Checking The Pulse Of The Kansas City Real Estate Market

Though our ever-volatile economy makes it impossible to say for sure what the future holds for the housing market, I’m feeling confident that when we look back on 2012, it’s going to be one of the best we’ve seen in Kansas City, Johnson County Kansas, Overland Park and much of the metro area in more than 5 years. It’s possible the housing market has hit rock bottom, though I’m still seeing reports where more than 10 million homeowners in the U.S. are upside-down on their homes. But the Armageddon of foreclosures predicted to come on the market last year never occurred.

No doubt, most people involved in the housing market (buyers, sellers, investors, mortgage lenders, real estate agents, appraisers, government agencies, etc.) are going to be more cautious going forward. We’ve gone through a crisis that has cost most homeowners and real estate investors a lot of money (or equity) and the situation at times has been likened to the Great Depression… any situation that gets that type of comparison is sure to be etched in our minds forever.

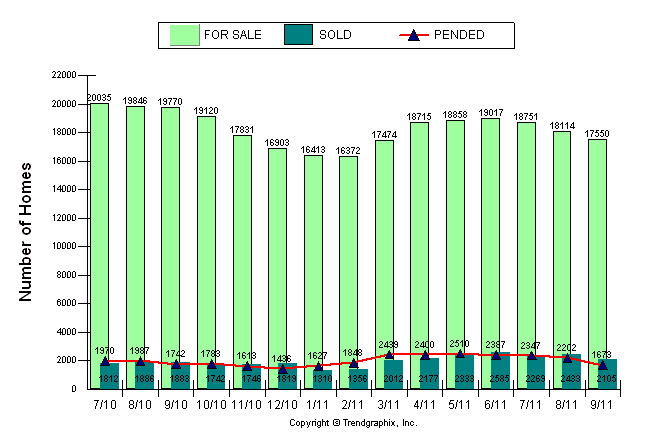

But the real estate market will go up – it always has – and I’m betting that within a few years we’re going to be in a balanced and stable real estate market. It’s already happened in many localized areas where buyers are buying to meet their living needs and sellers are looking for a reasonable return on their investment. Things are certainly looking up as I’ve seen national stats that show there’s 1/5 fewer homes on the market today than last year, listing prices have jumped more than 5% year over year (mostly due to an increase in buyer demand), the average time on market has been reduced 10%, etc.

Posted by Jason Brown