Checking The Pulse Of The Kansas City Real Estate Market

I’m happy to sell a client a $100,000 home or a $1,000,000 home. I’ll sell a condo downtown, a mansion in Mission Hills, a new home in southern Overland Park or a bungalow in downtown Olathe. I know the ins and outs of selling resale homes, new home construction, Short Sales and bank owned foreclosures. But before any Kansas City home buyer presents an offer to purchase, it’s important that they take a close look at the area’s market stats. While there’s no guarantees with real estate values, especially in our current real estate market, analyzing relevant market trends can shed light on where things are likely headed.

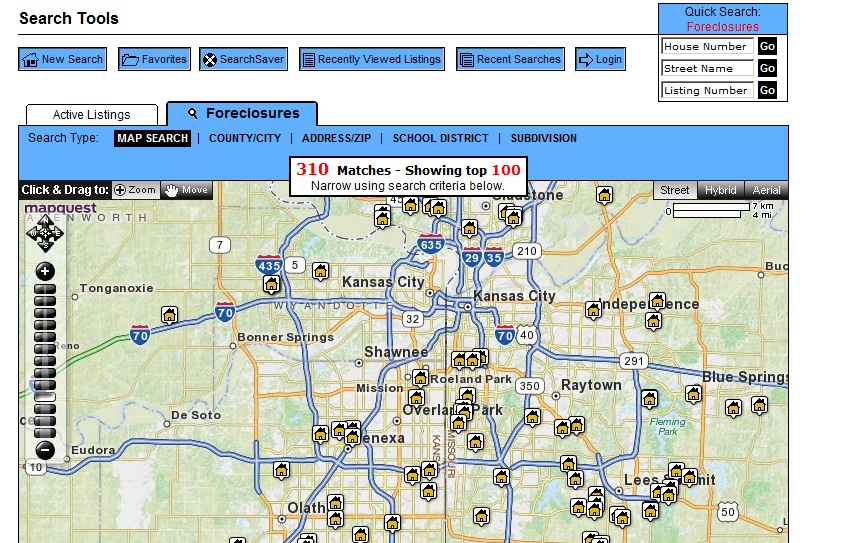

Buying a foreclosed home for $200,000 that sold a while back for $275,000 can seem like a wonderful deal. But if the market stats are very poor in the area, it’s possible the home might sell for $190,000 a year from now. Where’s the value in that? Did you also factor in the $25,000 to $50,000 in repairs it took to get the home on par with other area homes? Would it make more sense to buy a decently kept resale home for $200,000 home that sold a while ago for $250,000 and is located in an area with solid market stats? I really can’t stress enough, many foreclosure listing are worse deals than the resale home down the street. So don’t overlook the bargains while trying to find the deal of the century.

Now I’m not trying to run anyone off from buying a foreclosure property, assuming the property is completely through the foreclosure process and in the bank’s control. Banks have to hold reserves for each dollar they have tied up in an REO property. Bank’s also don’t like devoting resources to overseeing the property and they want to quickly rid themselves of liabilities that come with the non-performing asset. In other words, they want the property off their books. But buyers must be aware that, along with the lower sales price, comes the unknowns of buying an as-is home where the previous owner no doubt put no money recently into repairs and upkeep. If they didn’t have money to make their mortgage payments, do you think they fixed roof leaks, HVAC issues, structural issues, mold issues, radon issues, electrical issues, etc.?

So don’t just assume that EVERY bank owned property is a better deal than the resale just down the street. I liken it to the finished basement syndrome. Tons of buyers refuse to look at a homes that don’t have finished basements. They’ll pay $50,000 more for a home that has a finished basement than a comparable home that doesn’t have a finished basement. Instead they could have bought the $50,000 cheaper house, spent $30,000 finishing the basement and come out ahead. One other thing to keep in mind with bank properties. The bank’s typically aren’t going to sell a home at 75% off list price. They’ll instead price the home at market value (taking into consideration needed repairs) and then make incremental price reductions from there. This ensures the home eventually hits the right price point for at least one buyer, sells reasonably quickly, and nets the bank what it perceives is a fair value. So keep your options open and look at all homes, resale and bank owned, to ensure you get the best possible deal.