Checking The Pulse Of The Kansas City Real Estate Market

Do you have to do a termite inspection when buying a Kansas City home? If not, should you do one anyhow? The answer to the first question is maybe. Some lenders require a termite inspection be done on any home on which they’ll be providing a loan. If the lender doesn’t require it though, it’s up to the buyer whether they do one. But I can’t imagine any scenario where a buyer wouldn’t have a termite inspection done on the home they’ll be purchasing. For less than $75 in most cases, you’ll get the peace of mind knowing that termites haven’t eaten up the structural supports – or done other damage – to a home.

Per the base Kansas City Residential Real Estate Sale Contract, we refer to the inspection as “Wood Destroying Insect”. It’s the politically correct way to not single out just termites. I know you’re dying to hear the other types of wood destroying insects that might be present. Termites and carpenter ants are of primary concern but you can also check out this list of wood damaging insects. The inspection paragraph of the real estate contract states that termite treatment is the ONE thing that a seller is agreeing to address up front, if a wood destroying insect inspection finds evidence of any active infestation. The buyer doesn’t have to ask, demand or negotiate a treatment at that point. The seller would have to treat the property — as long as the inspection report is delivered to the seller within the inspection period.

So we’ve determined that a buyer would have to pay for the inspection and that a seller would be required to treat for the termites if any are found. But what if there’s damage to the structure from the termites? That’s open to negotiations just like any other item that may be found during a buyer’s standard home inspection. A buyer can ask for repairs to all, some or none of the damage that may be found. But a seller can also agree to make repairs to all, some or none of the damage that’s found. The inspection process sounds like a lot of fun, doesn’t it?

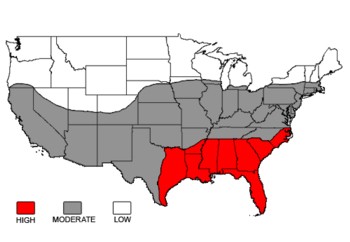

As one of my preferred home inspectors always tells buyers, it’s not a matter of IF you are going to get termites, it’s a matter of WHEN. Termites are hungry year round and over time will migrate to untreated feeding grounds (like your home). Here’s a great article on termites, what to look for, do-it-yourself tips and considerations to addressing a termite problem. Many home inspectors will include a termite inspection as part of the home inspection process. If you are a homeowner needing an inspection that’s not a part of the real estate process, most termite treatment companies will come and inspect your home free – with the hope that they DO find evidence of termites.

Here’s a list of some local Kansas City termite treatment companies…

Gunter Pest Management Everett Milberger Pest Control Orkin

Ragan Pest Control Terminix Weaver’s and Son’s Exterminators

Posted by Jason A. Brown